Crowdfunding and

Equity Crowdfunding Papers

- Can Capital Defy the Law of Gravity? Investor Networks and Startup Investment.

- Are Syndicates the Killer App of Equity Crowdfunding?

Also available in Chinese here.

- Some Simple Economics of Crowdfunding, NBER book Innovation Policy and the Economy, Volume 14, Josh Lerner and Scott Stern, editors

Also available in Chinese here.

- Slack Time and Innovation

- "Crowdfunding: Geography, Social Networks, and the Timing of Investment Decisions", Journal of Economics & Management Strategy (forthcoming)

- Can Equity Crowdfunding Democratize Access to Capital and Investment Opportunities?

- Overview of the JOBS Act, adopted and proposed

regulations related to equity crowdfunding

We are interested in finding post-docs or visitors with strong computer science background in applied machine learning. If interested, please contact us.

May 16, 2016

CAN EQUITY CROWDFUNDING DEMOCRATIZE ACCESS TO CAPITAL AND INVESTMENT OPPORTUNITIES?

The MIT Innovation Initiative Lab for Innovation Science and Policy releases report analyzing if equity crowdfunding can democratize access to capital and investment opportunities Policy briefing finds that Title III is not likely to provide everyday investors or high-growth ventures with significant new markets for funding the “next billion-dollar startup.”

CAMBRIDGE, Mass. — The MIT Innovation Initiative Lab for Innovation Science and Policy today releases a report considering whether, under implementing rules that become effective today, equity crowdfunding under Title III of the Jumpstart Our Business Startups Act (Title III) will open significant new capital markets for funding the “next billion-dollar startup” to the general public.

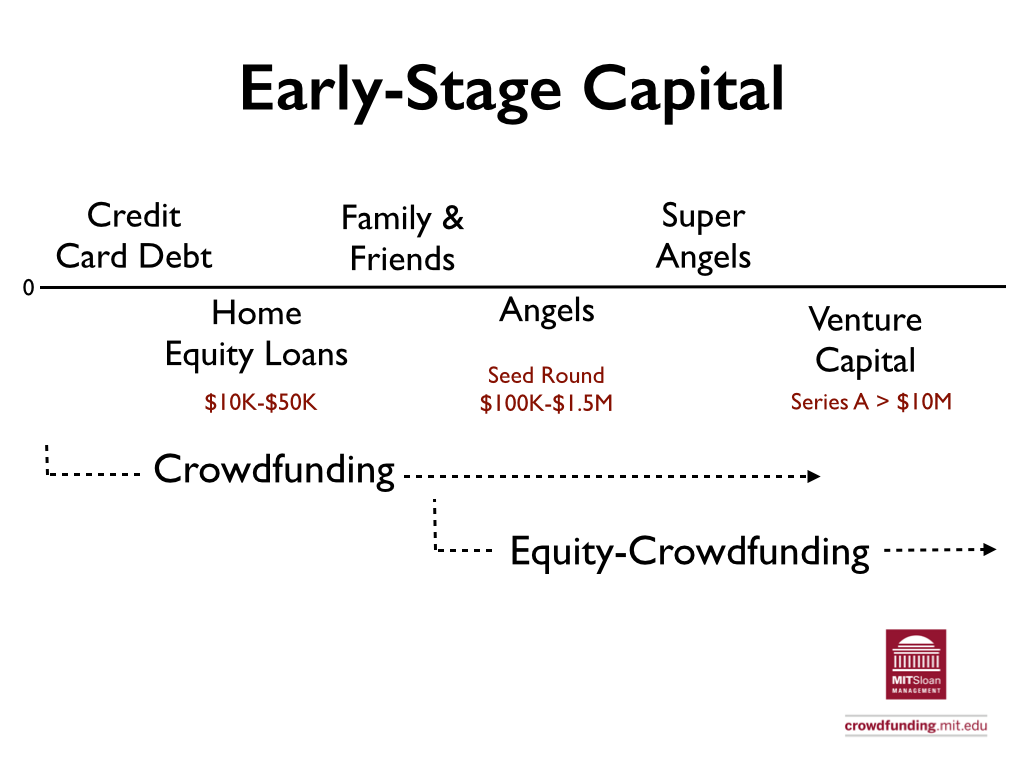

Ever since Kickstarter, Indiegogo, and others launched crowdfunding platforms, there has been great demand for crowdfunding to move beyond in-kind rewards to equity, so that a broader group of people might share in the returns of the “next big idea.” However, for the vast majority of people, getting in on the ground floor of an innovative, new startup via owning shares was not just out of reach, but out of bounds as well. To protect people from investing more than they could afford to lose and to guard against fraud, U.S. Securities laws made it illegal for early-stage startups to sell shares to regular people through online platforms.

That is all about to change. Today, implementing rules for Title III go into effect, allowing for the first time, startups to solicit funds from anyone in exchange for shares via online platforms. However, the question remains, are equity crowdfunding platforms likely to attract the next “billion-dollar startup” and offer real opportunities for everyday investors to share in the profits?

A new policy briefing from the MIT Innovation Initiative, “Can Equity Crowdfunding Democratize Access to Capital and Investment Opportunities?” considers this question through the emerging field of innovation science, applying a simple economic analysis to evaluate the likely impact and effect of the new equity crowdfunding rules. In short, the briefing finds:

• Title III is not likely to provide either everyday investors or high-growth startup founders with significant new markets for funding the “next great idea.”

• Title III could lead to novel opportunities for investment and experimentation, opening new avenues of funding for small businesses, means of building a committed user base, and vehicles for marketing and branding.

• Through experimentation with new market design rules, data streams (e.g. integration with verifiable growth metrics) and milestone-based funding, equity crowdfunding platforms could improve the quality and type of startups they are able to attract.

• Regulators should not lose sight of Title II—the provision of the JOBS Act permitting accredited investors to use equity crowdfunding—as an alternative pathway for achieving some of Title III’s initial goals.

While equity crowdfunding under Title III may not evolve as many may have originally hoped, it still may bring new forms of capital to small businesses and offer new and beneficial ways for people to connect with companies and causes about which they are passionate.

Download the policy brief here

Summary of Equity Crowdfunding Proposed and Adopted Regulations by Christian Catalini is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License - crowdfunding.mit.edu.

PAST EVENTS

Challenges of the Innovation Economy Round Table and Panel:

“Can Crowdfunding Democratize Access to Capital?”

MIT Innovation Initiative

MIT Sloan School of Management

Martin Trust Center for MIT Entrepreneurship

May 19th, 2014

1pm-2pm

Room E62-233

MIT Sloan School of Management

Building E62, 100 Main Street, Cambridge (MA) 02142

http://whereis.mit.edu/?go=E62

#crowdfundingMIT

The MIT Innovation Initiative and the MIT Sloan School of Management will convene a round table and panel on: “Challenges of the Innovation Economy Round Table and Panel: Can Crowdfunding Change Innovation?”. The objective of the forum is to solicit feedback from entrepreneurs, academics, angel and venture capital investors, crowdfunding platforms and policy makers on the proposed SEC regulations, and to discuss how the changes will provide new opportunities and challenges for innovation driven entrepreneurs and investors.

Register here to attend the event

I. Welcome Remarks, The MIT Innovation Initiative

- Prof. Fiona Murray, Co-Director, MIT Innovation Initiative, Associate Dean for Innovation at MIT Sloan School of Management, Alvin J. Siteman (1948) Professor of Entrepreneurship (10 minutes)

II. Some Simple Economics of Crowdfunding

- Prof. Christian Catalini, Assistant Professor of Technological Innovation, Entrepreneurship, and Strategic Management, MIT Sloan School of Management (10 minutes)

III. Panel Discussion and Q&A from the Public (40 minutes)

a. Panelists

- Prof. Ajay Agrawal (University of Toronto)

- Alex Mittal (FundersClub)

- Elliot Schneier (Fundable.com)

- Jay Finch (US Treasury)

- Jean Hammond (LearnLaunchX)

- Jeff Fagnan (Atlas Venture)

- Sam Guzik (Guzik & Associates)

- Thos Niles (Dragon Innovation)

b. Moderator: Christian Catalini (MIT)